Now that Telefonica closed down their Tu Me service, it is probably the time to ask if this is a sign of things to come.

Exactly a year and two days ago I’ve written about Telco OTT, outlining what carriers do when it comes to communications OTT offering. The most notable ones at that time were T-Mobile Bobsled and Telefonica Tu Me. Since then, Orange Libon has entered the arena with its own offering.

Now, Telefonica has indicated closing their Tu Me service:

The mobile carrier group Telefónica is to shut down Tu Me, a service that lets users call and message each other for free from their smartphones. Some users have received notifications that Tu Me will be no more as of Sept. 8

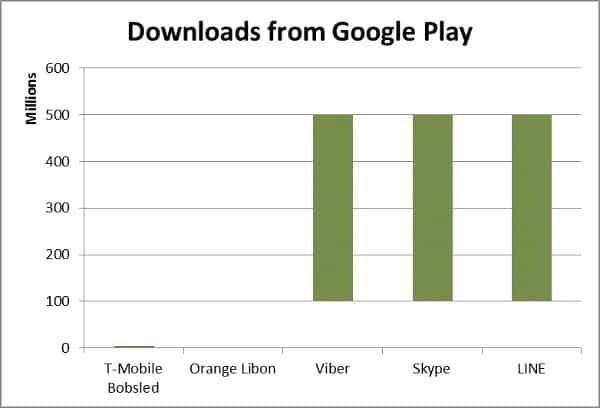

If you are looking for a reason, then I guess the graph below is reason enough.

The left hand side? That’s the estimated number of downloads on Google Play of the Telco OTT apps. Notice the barrier being placed at 5 million? On the right side? That’s the numbers for the OTT players… with this grim results, what’s the point? I bet Telefonica didn’t have more users either.

My personal view, is that carriers are not equipped to play the OTT game directly: there’s no use in trying to match the feature set and agility of the OTT communication companies with the size of a carrier. The better solution is anchoring that OTT offering with some unique capabilities of the carrier – access to the customer’s bill, providing cross devices access to his phone number, adding more control and self-service around it.

There is no point for a carrier to play in the current competition to zero that OTTs play, with no specific business model in sight. I am all for Telco OTT initiatives. I just think that need to be different enough from the rest of the pack to be successful.

Just to put my two cents in J

Wonder if Telefonica hasn’t been using essential advantages like user accounting, dial plans or SIP-out for their “Tu Me” service. Nevertheless, no doubt that most profitable VoIP share for telecom is B2B. E.g. suppressing amount of Multifon (by MegaFon, Russia) traffic is generated by IP PBXs. On the other side if we talk about VoIP over the mobile networks (3G) there’s no such great usage [in Russia] for Skype or Viber. Raw statistics figures that Multifon traffic is approx. 3 times higher than Viber’s value. Need to mention that most of this little advance is achieved with SIP-out. However dealing with OTT on a mass market is a big challenge for every mobile operator.

Thanks.

Consumer is always hard. Requires a lot of experimentation to get done right.

To be fair, your chart hasn’t included the 100+ other non-telco OTT VoIP apps which are also <5m downloads.

It's a market with lots of losers & a handful of winners. Statistically, it looks like the telcos are just doing no worse/better than average startups in this space. Doesn't mean there aren't potential niches though – but a full-frontal assault on Skype & Viber as standalone global comms apps is a big ask. Nothing wrong with having a try either – learning experiences are valuable, especially if (a) they're cheap, and (b) there's re-usable bits that can be turned into a platform.

I'm also curious to see if Telefonica keeps Tokbox just as a developer-facing platform, or if it also finds its way into a future WebRTC TuMe2 (TuMeTu?)

More like a 1000, but none of the Telco VoIP apps has gone anywhere interesting so far. It doesn’t mean that they can’t, it just means that they haven’t found the right mix to get them there (or that they aren’t looking hard enough?)