Last week, Viber’s business model was revealed. It wasn’t about stickers, subscriptions or PSTN dialing. It was just a simple exit strategy.

OTT. Over The Top. And in this case, instant messaging clients – are of interest to me.

I presented over a year ago about OTT players and their business models. It had 4 such models:

- Advertising

- Connectivity to PSTN

- Value added services

- Cashing out upon acquisition

Since then, the market has changed a bit and got somewhat more sophisticated. I then wrote about the ways OTT players are trying to make money.

It ended up I missed the best approach: stickers. So I wrote about stickers a few months ago.

While the OTT domain requires a post of its own – something I am brewing over for some time now, I guess there’s something to be said about the acquisition of Viber.

Best analysis I’ve read about it? Jon Russell on TNW: Rakuten’s $900 million strategy is to transform Viber into Line. But it won’t be easy

A few things to note here:

- Rakuten paid $3.2 USD per registered user; or $9 USD per monthly active user. The difference between the two is huge

- Registered users is interesting, but irrelevant at best. If anyone pays up, it is for monthly active users – that’s the immediate potential

- I am a registered user on Viber, but not an active one. And my registration? It is for my previous mobile phone number. Useless

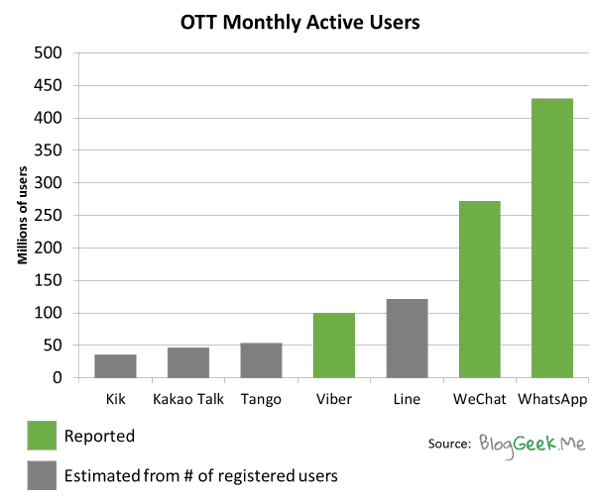

If we assume that registered versus monthly active is 2.8:1 in ratio, we get the following sizes for the biggest OTT players out there:

Here are a few thoughts:

- OTT vendors are distinctly smaller than they seem

- If someone talks about registered users, then the question is where is all of his activity

- The large players are WeChat and WhatsApp. The rest are playing catch-up

- WeChat and WhatsApp have VERY different approaches and business models. It will be interesting to see which one will stick in the long term

And one last thing about the acquisition of Viber. I always thought that these OTT players are prime target for acquisition by Telcos. I think that the window of opportunity for telcos in this regard is closing fast. As OTT players are shifting to new monetization domains, so does the companies that would want to own them. Rakuten is a commerce company – a retailer. And now after the acquisition, it seems logical.

–

OTTs are doing whatever they can to survive. Besides WhatsApp, they are all evolving into social/marketing platforms. But that’s for another post – sometime during March I guess. Stay tuned.