Amazon Chime SDK and Azure Communication Services mark the entrance of the cloud giants to the CPaaS space, and they are doing it from a WebRTC API angle.

Ever since Twilio became popular, a question was raised over and over again:

When will one of the large IaaS players (Amazon, Microsoft or Google) acquire them or start competing with them directly?

There was no good answer. At least not until 2020, where 3 things happened:

- The pandemic hit us and we had to stay at home and shelter, or whatever

- Video exploded

- Amazon Web Services and Microsoft Azure both launched their CPaaS offering

This. Changes. Everything.

(it doesn’t. It changes only some things, but bear with me)

I already discussed how the pandemic changes priorities for CPaaS vendors. This new development is going to make things more of a mess.

You should also check out my recent coverage of Twilio Signal 2020 virtual event.

Table of contents

Why now?

Amazon Chime SDK was already announced and launched close to the end of 2019. They already have customers and success stories under their belt. Why am I just now getting to look at how IaaS vendors are changing the market?

Probably a bit because I am doing the update to my WebRTC API platforms report this month. But also because of Microsoft’s announcement of their Azure Communication Services.

Amazon Chime SDK

Amazon started the work to video communications by the introduction of Chime a few years back. Chime is an enterprise communication service (in the UCaaS space), which is akin to Zoom, Google Meet and Microsoft Teams. It enables companies to communicate internally and externally via video and voice with a better set of collaboration tools than just phone calls.

For some time now Amazon Chime was also offered as a whitelabel solution that vendors could “make their own” and integrate it with their service. But it doesn’t allow for much flexibility in terms of the workflow, business logic and user authentication. This has led Amazon to introduce the Amazon Chime SDK.

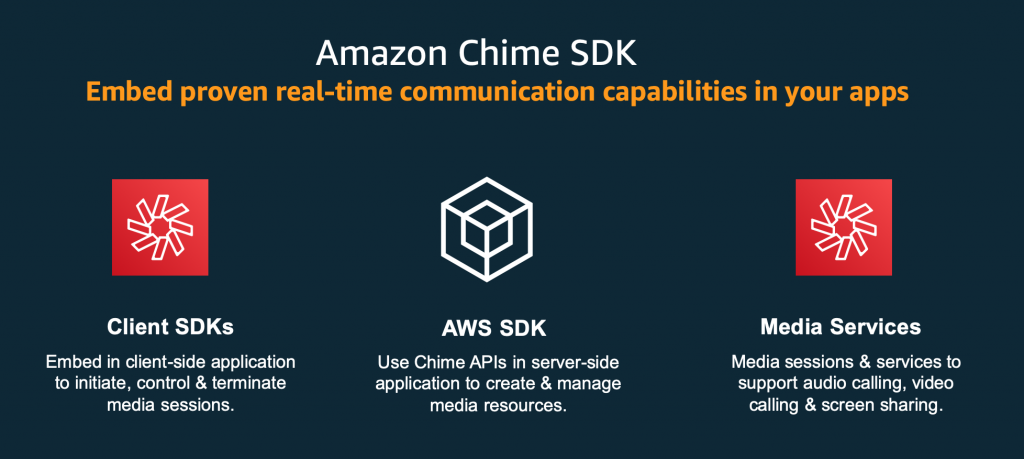

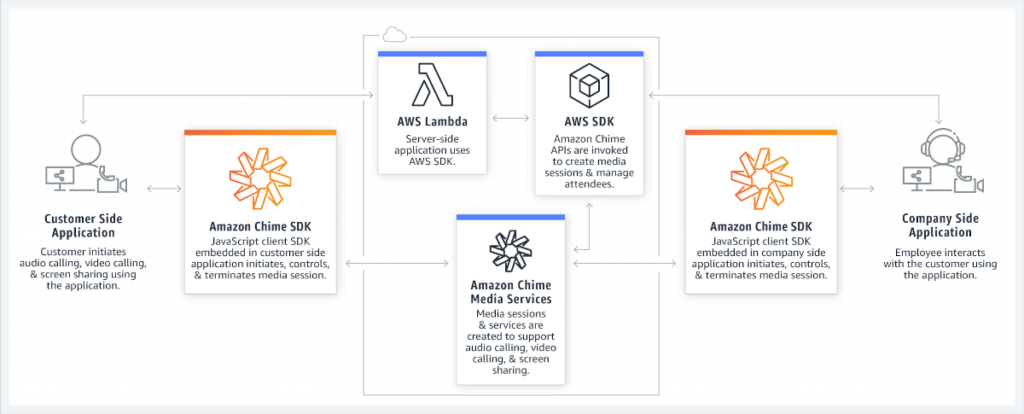

The Chime SDK is one rung lower in the stack. It enables a developer access to the logical building blocks of communications, offering a pure communication API that can be used to connect to any other service. A direct competitor to the other CPaaS vendors offering video capabilities.

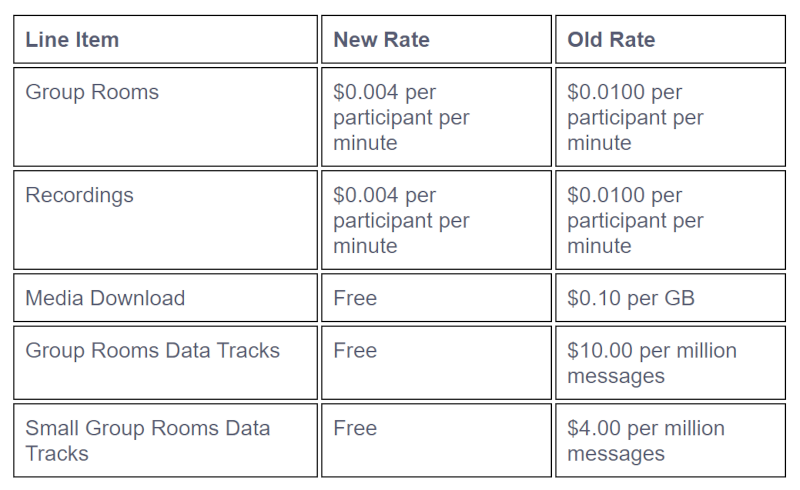

What Chime SDK did to really disrupt the market was lower the price point per minute. It comes at a rate of $0.0017 per user per minute. Twilio answered with its own price drop in September 2020:

The new rates are still above the Amazon Chime SDK price points, but they are 40% their previous price points.

It should be noted that peer-to-peer calling available in Twilio Programmable Video is at $0.0015, lower than the Amazon price, but of a slightly different service and feature set.

What Amazon is “selling” here? The AWS story. From the main Chime SDK page:

AWS Lambda is already there. Connectivity to other AWS services are also part of the bigger spiel.

Azure Communication Services (AKA ACS)

Microsoft just announced Azure Communication Services in a public preview. This is a full CPaaS offering that includes Video, Chat, SMS and Telephony calling. The interesting tidbits alluded to in the announcement:

- Azure enabled, with all the knobs and pieces to connect it to other Azure services; along with the security and compliance of the Azure cloud

- Connectivity with Microsoft Teams, which isn’t available yet in the public preview

Watch that video above. There’s a visual explanation of remote visual assistance. I’d never think of explaining embedded video communications or programmable video communications this way – because I am in the industry for this long. What Micsoroft is doing here is educating the market in the most basic way possible. Something we were missing in our market without even knowing it. This type of an approach can work well in the enterprise space, which hasn’t adopted such services in droves just yet.

What makes this so interesting is this:

- Microsoft is the only CPaaS vendor who has a huge UCaaS offering. Huge as in up to 5B (or more) meeting minutes a day. Starting off with the same underlying scalable infrastructure means resilience, reliability and scale

- This is part of Azure and not tied to Teams. Like the AWS Chime SDK offering, the tie in with machine learning in their compute cloud brings value to developers using Azure already

- Microsoft has Office as another huge asset. If they can make the connection to it here, this is another great differentiator

On pricing, Microsoft was a bit more traditional and less bold than Amazon, sticking to the $0.004/minute price point the market seems to have adopted.

The new model for Video CPaaS?

Even before Amazon and Microsoft joined this space, there were two objectives you could see in the mid-term and long-term roadmap for video CPaaS vendors:

- Add support for machine learning

- Introduce higher level of abstraction

These map where the new video CPaaS is headed, and the fact that Amazon and Microsoft both come with this “built-in” will accelerate things further.

Machine Learning

Everyone’s doing machine learning these days, and it is part of the future of communications and WebRTC.

Amazon Chime SDK will be offering their noise suppression capabilities. Connect to Kinesis and enable access to all their other machine learning services.

Microsoft in their launch already mentioned Azure Cognitive Services as something that plays/will play nice with ACS.

Other CPaaS vendors are figuring out their way in this space as well, but part of their offering is usually how to gain access to the media for… sending it to the cloud for machine learning analysis. That cloud is going to be AWS and Azure more often than not. Being in that cloud to begin with is going to be an advantage for these cloud vendors and their CPaaS offerings.

Also remember that cloud vendors live and breath machine learning already. CPaaS vendors? Less so.

Higher abstractions

Everyone in this space is talking about simplicity now.

How can I get developers to do their work in hours versus days. Days versus weeks. Weeks versus… no… weeks is too long already.

While this is unrealistic for a full fledged, polished service, it is something that works well towards an MVP or a first stab at a ready product.

Some do this by offering open source or reference applications on top of their CPaaS APIs. Others by offering this as a set of ready-made and highly configurable widgets.

It doesn’t seem like anyone has cracked the code of what is needed here, but the growing focus shows there’s something missing. Especially if we want developers to need to know less about WebRTC and media routing and more about their application logic.

I think that Amazon and Microsoft joining this market will speed up the efforts in this domain, as companies search for differentiation and quick onboarding.

Why telephony is dying and communication is growing

Both Amazon and Microsoft are leading here with video, adding chat and telephony later. Later can be immediately after the initial launch, but it is still later.

In the past it made sense to do the opposite. Lead with PSTN and SMS as money makers, and add WebRTC voice and video, waiting for them to grow in adoption.

Taking the opposite approach shows where the future of consumption is.

Winners

Who are the winners when CPaaS is done by the cloud vendors?

Users

If cloud vendors are joining this game, it means there’s enough $$$ in this market to make it interesting, which means more users are consuming such services.

The market education that these cloud vendors are capable of doing and their reach is higher than the other CPaaS vendors, excluding maybe Twilio. This will end up with more enterprises and businesses offering such services and end users using them.

Tier 1 cloud vendors

Amazon and Microsoft. Their timing couldn’t have been better.

If I haven’t known that Bill Gates is causing the pandemic so he can chip us all when his vaccine comes to market and causes all birds to fall from the sky due to 5G, I’d might end up saying that Jeff Bezos is to blame because he wanted the Chime SDK to grow in market share.

In all seriousness though, this gets both Amazon and Microsoft in front of the developers that use them for additional types of services that these developers are going to consume.

Smaller cloud vendors

Digital Ocean and Oracle.

Why are they winners? I am not sure how Twilio can continue running Programmable Video on top of AWS and compete with AWS Chime SDK on price and geographic spread.

Same for the other CPaaS vendors who might be using AWS or Azure. They will be thinking hard if they want to keep their media stacks on these platforms or move them elsewhere. They can move them to Google Cloud, but Google just might introduce the same capabilities and become a competitor. Next in line will be Digital Ocean and Oracle, both cloud vendors that are carrying real time media traffic already. If I were a sales person there, I’d pick up the phone today and call the CPaaS vendors one after the other…

Developers

A definite win. More choice. In clouds they already use. With a price war coming up – and free credits for startups to contemplate instead of “free” minutes.

What’s there to lose?

Losers

Who are the losers when CPaaS is done by the cloud vendors?

CPaaS vendors

They now have more competition. And not from smaller startups, but rather from the leading cloud vendors.

Cloud vendors already cater to developers, and a larger audience of developers.

Things are going to get interesting for these vendors, as they need to rethink differentiation, their own infrastructure and their pricing.

Twilio

Twilio is the leading CPaaS vendor today.

They are using AWS. Everywhere.

This is definitely hurting them and will hurt them more moving forward.

Out of all the threats to Twilio, having cloud vendors competing head to head with them was the biggest one, and it is now happening.

It made sense for someone like Amazon to acquire them and use them as the communication stack for AWS. now it won’t happen.

Maybe Google will acquire them, though this seems far fetched to me.

3 leading cloud vendors.

- Amazon

- Now has AWS Chime SDK

- Lots of adjacent services for developers

- Microsoft

- Now with Azure Communication Services

- Lots of adjacent services for developers

- Owner of Microsoft Teams, used as the underlying technology and media stack, with the ability to connect ACS to Teams if and when needed

- Got Office 365 as another huge asset

- Google

- Nothing in communication APIs

- Owner of Google Meet and Google Duo

- Leveraging RCS with carriers and in Android

- Has G Suite and Android as huge assets

- Has Chrome and Chrome books as assets

- Did I say no communication APIs?

Google is left behind in its communication APIs for developers, which is sad, considering they are the main driving force behind WebRTC.

I wonder if and when will Google close this gap.

Developers

This will definitely rattle the existing vendors. Some of them might not make it through. So choice will again get a wee bit limited as this plays out.

While cloud vendors are great, their support isn’t the best. They tend to offer support to the smaller developers and companies through third parties and not directly, so there’s going to be less of that available. And that for a domain that is still very complex in its nature.

Developers both win and lose from this development.

Updating my WebRTC API report

There’s a lot of change in the CPaaS domain. I mostly look at these vendors from a WebRTC prism, but not only.

This past month I’ve been working on updating my Choosing a WebRTC API platform report. I had a lot of briefings with the various vendors, researched their websites, added vendors, removed vendors. Grueling work.

The updated report will be published during October. It will include ~25 vendors, and touch everything from build vs buy, selection KPIs, vendor listing and pricing.

If you are looking to understand this domain better or need to select one vendor over another for an important project, then this report is for you.

Now that Andy Jassy has taken the reign, this should make things even more interesting for AWS.

What about the likes of Bandwidth with their own Tier 1 network – can the vertically integrated model shield them from competition?

How and why?