Are OTT players like Skype, Viber or WhatsApp actually making any real money?

It’s a reasonable question to ask when you consider that the underlying reason for their success in winning over hundreds of millions of users in the first place has largely been because the services they offered (at least initially) were free.

From there, most moved, or tried to move, to the “Freemium” business model whereby a small percentage of the service’s users (let’s say 1%, for example’s sake) would hopefully choose to pay for a premium set of features. The problem here lies in persuading that 1% to actually pay anything…

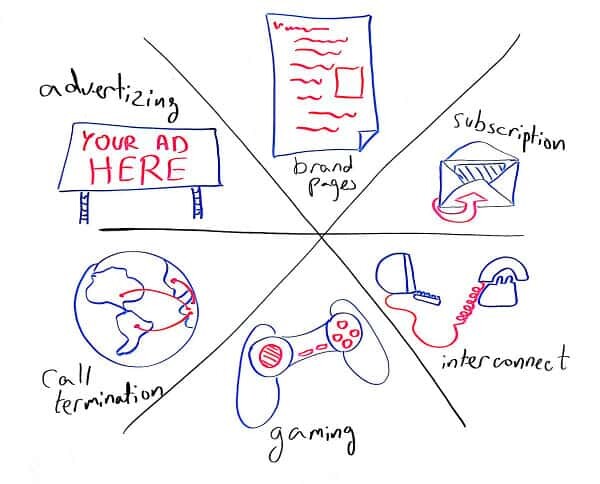

So if you’re an OTT player and no company has yet decided to snap you up in a fantastic acquisition deal, which business models could you introduce in order to start seeing some real revenues? Here are a few that I’ve collected for you:

Subscription

Last week, WhatsApp, the popular messaging app, switched from a one-time payment on Apple’s iOS to a yearly $0.99 subscription model consistent with its policy for Android – a move which GigaOm’s Lauren Hockenson described as “a wise maneuver for the company”. Hockenson went on to explain that carriers now may have even more reason to be afraid of this app, even though it’s no longer going to be free:

Installing such a low-cost yearly plan makes it a no-brainer for those who participate in the some-odd 8 billion inbound and 12 million outbound messages that filter through the app every day because it’s still so cheap compared to premium text or roaming charges. WhatsApp, in turn, gets a steady stream of new revenue.

Personally, with 200 million subscribers already, I also don’t think they could have waited any longer to change their business model from a one-time free subscription to something more viable, as they will soon run out of room to grow.

Interconnect

Interconnect is the most common way to make money with VoIP, especially when it comes to connecting across different carriers and countries. Essentially it involves users talking or video conferencing with each other inside a closed garden of a service (Skype, anyone?). But if a Skype user then wants to dial out to the rest of the world or receive calls from people using a PSTN (which is the regular telephone network), the OTT player can charge money, making a margin over the interconnect rates.

Skype (the largest international carrier of voice calls) is doing it. So is Rebtel, among others. I think the problem here is that the larger and more successful you are, the lower the amount of calls that will actually need to be made via PSTN since it’s increasingly likely that the people wanting to communicate with each other might be already using the same OTT walled garden service.

Gaming

Look at the business model for Tango, the mobile video calling company:

We believe video calling should be free to everyone […].We have a lot of ideas on how to make money once Tango reaches a critical mass, and are going to explore and experiment with a wide variety of ways to monetize mobile video calling including offering premium services.

I think this statement dates back to its early days, but even though Tango has now managed to attract an impressive 120 million users, it still has no real business model when it comes to offering premium services. Instead, reports The Next Web’s Jon Russell, it’s now trying to woo the gaming industry by launching a new content platform for developers, which offers them “social hooks” into Tango’s user base in return.

Monetizing communication via gaming, usually through in-app purchases, is a direction that quite a few OTT players in Asian market are starting to take, including the Japanese service LINE with 150 million subscribers (now 200 million), China’s WeChat, and Korea’s own KakaoTalk.

Call Termination

Viber has never had a real business model but is now trying something new: this VoIP mobile app player with 200 million users is now testing out a model whereby the operators will pay Viber to carry out call termination which means enabling the call to reach its destination. (And if Viber subsequently does decide to offer this service, it will be available on an optional basis). This is an interesting idea because in Viber trying to become an international call terminator, it’s actually putting the payment burden on the operators, rather than on their users.

Ads

OTT players have tried to offer advertising alongside their communication services on and off throughout the years. Skype added it a couple of years ago but personally, I think the poster child of this model in communication is ooVoo, who were one of the first to use this model and make money out of it. Their free video chat service carries ads, and they also monetize their service via a toolbar that they install on the user’s browser. But if you pay for the premium version of their service, the ads are removed.

Brand Pages

When we think of company brand pages, Facebook usually comes to mind. But in Korea, KakaoTalk has now started a digital marketing monetization campaign by introducing the FriendPlus brand and celebrity interface pages. Vendors pay KakaoTalk to host them with their own brand page that users can become friends with in order to receive offers and exclusive content.

And the winning model is…

I have no clue. And I think most of these companies have no clue either. They have a great business, a large base of subscribers. Some paying – most don’t. Which of these models make for a sustainable communication OTT player is beyond me – since they are all rushing towards many directions, I’d say this is still early days.

Nice summary Tsahi. It may be worth noting those that have no clear/obvious charging model may be aiming at a high valuation and buy-out later on, in some cases that may be their strategic monetization plan rather than coincidence, maybe worth noting.

Moreover, an extension to brand pages could be “white label” offerings that allow developers to use the platform (save development efforts and pay for using ready-made features). This may however somehow be connected to the other points as well (e.g. use ready-made features for free and create more users = revenue on interconnect minutes), not sure it is a separate point.

Best regards

Sebastian

Sebastian,

All of your points are indeed valid. I tried focusing on ways they want to make money out of running their business and decided to leave aside the acquisition angle of it, but you are correct that some (most?) of these companies are probably praying to get acquired instead of building a viable business.

I think the white labeling part that you suggest is more inline with what they are doing with gaming – where what they effectively sell is access to their internal “social graph”, with easy tools around it.

Hi Tsahil

I thought at first it meant gaming within these apps/platforms (so to extend them), but I agree it actually fits indeed to what I was referring to with gaming as good example. Thanks for following up.

Sebastian