Time for another refresh of my WebRTC CpaaS report.

Call it what you want – WebRTC PaaS, CPaaS, API Platform, Communication API – they all end up doing a couple of things for the industry:

- Simplify and streamline the use of programmable communications that can be embedded virtually anywhere

- Make use of WebRTC as one of their building blocks. Usually a significant one

- Run in the cloud. Though not necessarily and not always

Today, I am launching the update of my Choosing a WebRTC API Platform report. It is now in its 6th edition with almost 4 years behind it already.

Before I begin – a thanks to my sponsor on this one

This time, I have a launch sponsor for the report – one of the new vendors that are profiled in it – Vidyo.

Vidyo launched recently CPaaS that enables you to embed real time video experiences into applications (here’s my recent analysis). While they are not the first in the market to do so, they bring with them some interesting SVC capabilities.

Vidyo launched recently CPaaS that enables you to embed real time video experiences into applications (here’s my recent analysis). While they are not the first in the market to do so, they bring with them some interesting SVC capabilities.

You can read more about SVC in this guest post by Alex Eleftheriadis – Chief Scientist & Co-founder of Vidyo.

SVC is a mechanism by which you can layer a video you are encoding in a way that allows peeling off the layers along the path the video takes – without needing to decode the video. This seemingly innocuous capability brings with it two very powerful capabilities:

- Better multiparty conferencing routing and control – because we can now easily decide in our SFU/router which layers to send based on the dynamic conditions of the call (network, CPU, screen size, etc)

- Better resiliency to bad network conditions – because we can take the lower layer(s) and add things like forward error correction to them to make them more resilient to packet losses (we can’t do it to all layers because that will just eat too much bandwidth)

That second capability is often forgotten – it is what can make or break great video experiences over things like WiFi or 4G networks.

SVC is starting to make its way into WebRTC, and you see developers tinkering with it. Vidyo has been at it longer than most, and have it boiled into their product. Vidyo already has SVC as an integrated part of their backend as well as their mobile and PC SDKs. When will that get enabled in their WebRTC part of the offering is a question to them, but you can assume it will have all the bells and whistles required.

Anyway, you can learn more about Vidyo.io in this report sample.

Why should you purchase this report?

This report will guide you through the process of deciding how to tackle the task of developing your product:

- It explains what WebRTC is briefly, and reviews the WebRTC ecosystem actors

- It lists the challenges you will face when developing products that make use of WebRTC

- It explores the various approaches to develping WebRTC – anything from self-development up to full CPaaS

- It shows you the key performance indicators that can guide you through your selection decision

- It profiles all relevant WebRTC PaaS vendors to make the selection process simpler for you

Having this kind of information can reduce the risks of your project by enabling you to make a more informed decision.

What’s new in this report?

You still won’t find marketing BS in this one such as weird market sizing numbers going to billions of dollars or devices with estimates of 2030.

That said, there are 4 important changes I made to the report:

#1 – New Vendors

The main driver for these report updates are two: major changes in existing vendors (multiparty video support in Twilio for example) and new entrants to the market.

In this update, we have 3 new entrants to the market, and they are all interesting:

- Agora.io, who are now adding WebRTC support to their platform

- TrueVoice, started with 3D voice and are now introducing video capabilities

- Vidyo.io, who are also sponsoring this report launch – check out there free profile (have I already mention that?)

I will be writing some more about the new video players in CPaaS next week.

#2 – Outlier Vendors

As time goes by, vendors and their products change and shift focus. Since my first release of the report this was bound to happen. Which is why I “migrated” some vendor profiles to a new section about outliers.

In some cases, you can use an outlier vendor instead of a CPaaS one, assuming your use cases fits what they have on sale. These vendors essentially cover a specific type of behavior (such as contact centers who offer visual assistance, or a click to dial consultation service for independent professionals). They might also target a very niche set of customers that just not fit what I am looking for in this report.

While they are SaaS companies in nature, they do have APIs and do offer some deep integration capabilities – and they are viable approaches to research for your product.

Two vendors who were profiled in this report in the past now find their home in this section:

- Respoke by Digium, who now focus on Digium’s Asterisk customers and cater to their needs only

- SightCall, who now focus on Visual Assist and no longer catre the more general purpose CPaaS market

#3 – Closed Platforms

And then there are platform vendors that got acquired, shut down or stopped catering for developers altogether. They were once profiled in the report, and are no longer with us.

They now have a whole section for themselves.

The reason I am not removing it? It isn’t due to sentiment. It is because this stuff is important. I believe that understanding the past and how these dynamics work will help make a better decision. It will give some more insights into the stability and trajectory of the “living” vendors in the report.

Whose gone to my deadpool section?

- AddLive – they were acquired in 2014 by Snapchat (yes, that company with the successful IPO). They immediately closed their doors to new customers and are shuttering their whole API service this year

- AT&T WebRTC Enhanced APIs – AT&T is still alive and kicking obviously. Their API developer platform is also active. But the WebRTC parts of it were shutdown. While no reason was given, it is probably due to low traction

- ooVoo – they tried appealing for developers by opening up their existing platform. Just to shut this initiative down recently. I am assuming similar reasons to AT&T’s decision

- OpenClove – I am not really sure what happened to them. The site is live, though copyright is from 2014. Up until last year, I got replies from my contacts there, but no more. There’s no indication if this is alive or dead, which is dead enough for me

- Requestec – who got acquired by Blackboard and taken off the API market

Each vendor section here is frozen in time, at the last point of its update. Reasons for its death have been added.

Hopefully, future updates of this report won’t make this section grow any bigger.

#4 – Multiparty Explainer

It is 2017, and it seems that many of the WebRTC API Platform vendors are now offering multiparty support of one kind of another.

When it comes to video, there’s a variety of alternative technologies of getting there. These affect pricing, quality and flexibility of the solution. It was appropriate to add that as an additional factor in the report, which means that now, there’s a new appendix in the report giving an explanation of the differences between mesh, mixing, routing, simulcast and scalability.

The Timespan Aspect of the report

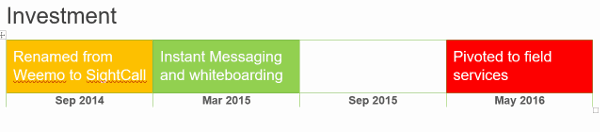

This is something I added in the previous update and just… updated again in this round.

When I got to updating the vendor profiles this time around, I found this addition really useful for myself – and I try to follow the industary and gauge its heartbeat on a daily basis.

This is a small section added at the end of each vendor’s profile, where I added an “investment” section – an indication of what did the vendor introduced to the market since the pervious report. This can really show what these vendors are focusing on for growth and are they in the process of pivoting out.

Take for example the investment section I have for SightCall:

Green indicates investment into the API platform. Yellow indicates some investment. White with no text means nothing to write home about. And red means defocus in investment – putting money in non-API activities.

In this case, it is understandable that after SightCall’s investment in its Visual Assist service (May 2016), which was probably successful for them, they pivoted out of the general API market. Which is also the reason there is no update for it in March 2017.

This this is now part of each vendor’s profile in the report, so you can now factor it in with your vendor selection process (I know I would).

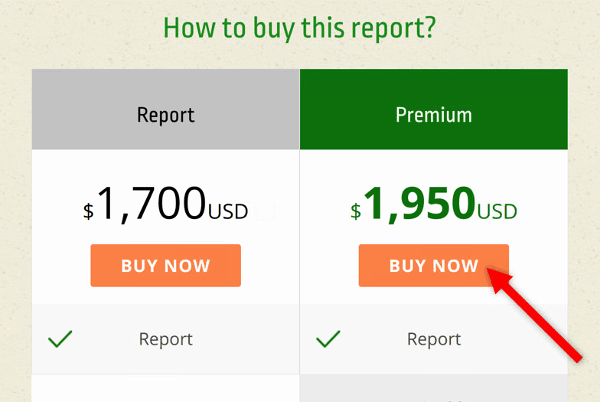

How about the price of this report?

The report’s price is $1950 USD. That includes:

- The written report (all 200+ pages of it)

- Online vendor selection matrix to use for comparison purposes

- Yearly updates – you’ll be elidgable to receive the next update of the report when it comes out

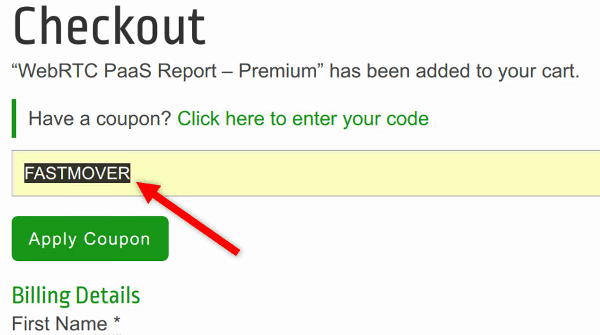

If you make your buy decision today, you’ll get a 35% discount by using the FASTMOVER coupon.

How do you do that?

Click to purchase the Premium package of the report.

Then on the shopping cart, make sure to indicate the coupon.

Prices go back up tomorrow at midnight, so better purchse this report now.

hi,Webrtc is developing rapidly,especially in China,We are a professional provider of Pass cloud service with Webrtc,You can pay attention,We have p2p calls, video meetings, live, intercom scheduling SDK