Twilio Signal 2021 defines Twilio as “API”, “programmable”, “platform” and “customer engagement”. Here’s how it intends to compete in its many markets.

Twilio Signal 2021 is when Twilio officially pivoted from CPaaS to a Customer Engagement Platform. This is the reason Twilio acquired Segment last year, and the explanation of how it intends to leverage that acquisition.

Every year, I put time aside for Twilio Signal. Either in person or remote, going through the sessions and paying extra attention during the keynote. This has developed into a comprehensive view and research resources about Twilio that I’ve put up. It is time now to review what we had at Twilio Signal 2021.

I also conducted this interview with Twilio Co-Founder and CEO Jeff Lawson:

Table of contents

- Twilio Signal Keynote 2021

- Defining Twilio in 2021

- Twilio by the numbers

- The Pivot: Twilio Customer Engagement Platform

- Twilio Signal 2021 keynote announcements

- Regional Twilio

- Twilio MessagingX

- Twilio Voice and IVR Now

- Twilio Intelligence

- Twilio Flex

- Segment

- Announcements that didn’t make it into the keynote

- What Twilio isn’t

- What’s next for Twilio?

Twilio Signal Keynote 2021

Twilio didn’t put the keynote for Signal 2021 on YouTube (yet), but they did have it as part of their all-day Signal TV session. The video below will get you the keynote, which was around 90 minutes long:

As events go, Twilio Signal 2021 was quite a good experience for a virtual event. It was a bit hybrid, but most of the focus and action took place on the virtual side of it (or at least felt that way for me as a virtual audience).

Defining Twilio in 2021

Twilio never liked or used the term CPaaS. I am not really sure why.

The Twilio pivot

There were 4 words that came time and time again during the keynote, and I think they are the center of what Twilio gravitates around today: “programmable”, “platform” and “customer engagement”.

Everything Twilio does can be found around these words, and I believe also every type of adjacent business they will try to go after will have two or more of these words in them in one way or another.

Twilio tried to show this shift and to move away a bit from APIs. It will take more than a single Signal event to do that.

Jeff Lawson, Co-founder and CEO of Twilio, started by presenting the idea of Customer Engagement and ended the keynote with the Customer Engagement Platform taking us in a complete circle around it.

Why did Twilio pivot now?

Twilio is the leader in CPaaS. It has been so for many years now, defining and redefining what CPaaS is. Twilio is also ahead of all of its competitors. Way ahead. It acts as a best of suite provider, which covers most if not all of what CPaaS is, with depth of functionality in many of its offerings.

As such, it sees and knows the market. It also knows the market’s limits. Which means it understands its estimated growth. It had to pivot and start eating up more adjacencies to continue growing at an accelerated rate. But there probably aren’t enough adjacencies it can go after that can be defined as CPaaS or as communication APIs. So they went up the food chain, marketing customer engagement as their target.

Twilio’s reasoning for doing it now?

- Size of the market. The communication market has been said to be $1T. Twilio believes it is much bigger, due to the slower shift of communications towards the cloud and the fact that communication is now used in new ways, not attributed in the original market sizing made by analysts

- Architectural shift. The shift to the cloud. This one is driven by customers who need to do more, faster and more flexibly. Legacy vendors can’t do it, while Twilio as a cloud native vendor can offer such capabilities

- A focus on “proactive”. Most use cases in business communication so far have been reactive in nature. Now they are a lot more proactive. That shift requires new capabilities, ones that require access to more data and being smart about it

To be frank, the architectura shift as well as the move from reactive to proactive have been industry themes for over 10 years. The pandemic simply accelerated these changes, and probably accelerated Twilio’s own pivot. It is also a new language that Twilio is now speaking, so we hear it from them as well.

Twilio by the numbers

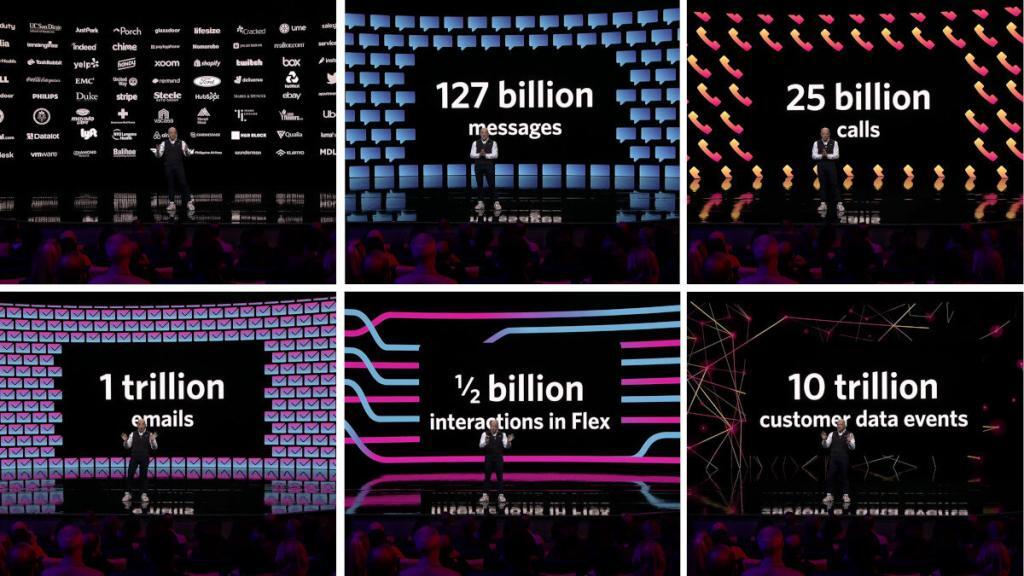

Each time, Jeff starts his keynote with numbers, showing off Twilio’s size. It is interesting each time to see which numbers he shares and highlights at the beginning of the keynote. This year?

Twilio Signal 2021 numbers versus 2019 & 2020

What numbers did Twilio share in the beginning of its keynote this year versus previous years?

| 2019 | 2020 | 2021 | |

| Customers | 160,000 | 200,000+ | 240,000+ in 180+ countries |

| Text messages | – | – | 128B (100% growth) |

| Emails | – | – | 1T (5.8B single day peak) |

| Calls | – | – | 25B |

| Flex interactions | – | – | 0.5B |

| Segment data events | – | – | 10T |

| Interactions | 750B | 1T | – |

| Unique phone numbers | 2.8B | 3B | – |

| Calls/minute | 32,500 | – | – |

| Peak SMS/second | 13,000 | – | – |

| Email addresses | 3B/quarter | 50% | – |

| Video minutes | – | 3B | – |

| Developers | 6M | – | – |

This is in-line with its pivot, as many of the original numbers aren’t even mentioned.

So… Twilio is now even bigger, and it is pivoting.

- Customers came first. Not as a number, but as logos, showing how strong and diverse Twilio’s customers are

- It was important for Jeff to share that these customers include startups, enterprises and ISVs – Twilio isn’t catering only startups

- I think it was the first time Twilio shared the countries of origin for its customers. 180 of them. With anywhere between 195 to 249 (depending who is counting), that’s quite impressive. The reason to share this number? To signal that Twilio isn’t only big, but it is big everywhere (ie, outside the US)

- Text is still the most important thing for Twilio. Not as SMS, but as “text” – omnichannel. We will see later that this still means SMS

- For calls, Twilio shared the number of calls and not peak, with 25B as that number

- Flex interactions. For the life of me, I still can’t understand what interactions are, and probably no one does. Twilio simply wanted to say “Flex is a real and it is big” – to remove the doubt in the business success of Flex in the contact center space

- Segment data events are… as bad as Flex interactions as numbers go – I don’t understand what that means. But saying 10T is always good, cementing Twilio’s “dominance” on the CDP (Customer Data Platform) space Segment belongs to

Twilio and social good

I haven’t added the social good related numbers that Twilio shared not because they aren’t important, but because they require a separate mention.

Twilio made the decision years ago to be a company that does good in the world. It also decided to put its money where its mouth is, through its twilio.org operation and its shift to become a diversified company.

Time is spent each year at Signal during the keynotes as well as in specific sessions for social good, and this year was no different.

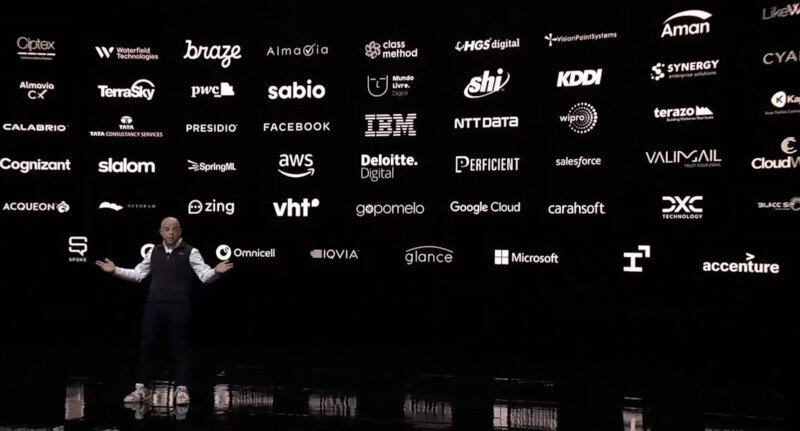

Twilio and partnerships

Jeff mentioned the strategic partners of Twilio at the beginning as well. These are getting more important to Twilio as it grows and shifts towards customer engagement.

Twilio dogfooding

Twilio is dogfooding its own products. For Twilio Signal 2020 and 2021 it has been hard at work building its own hybrid events platform. Still at its early stages but quite commendable.

Each year, additional pieces of the Twilio building blocks are being used to create these events. It will be interesting to see if in 2022 they will continue with this trend or go to a live-only event. Another question is if and when will they productize this as a programmable events platform.

The Pivot: Twilio Customer Engagement Platform

After the numbers it was time for the pivot. This is where Twilio moved away a bit from its roots into communications towards custom engagement. And the way this is explained by the fact that Twilio now isn’t only about communications but about all experiences with customers. Customers “drove” Twilio there, which led to the creation of Twilio’s Customer Engagement Platform.

Setting the stage

Two things here:

- Twilio isn’t only about CPaaS anymore

- Twilio focuses on communications of business with customers. They aren’t after the UCaaS market in any way

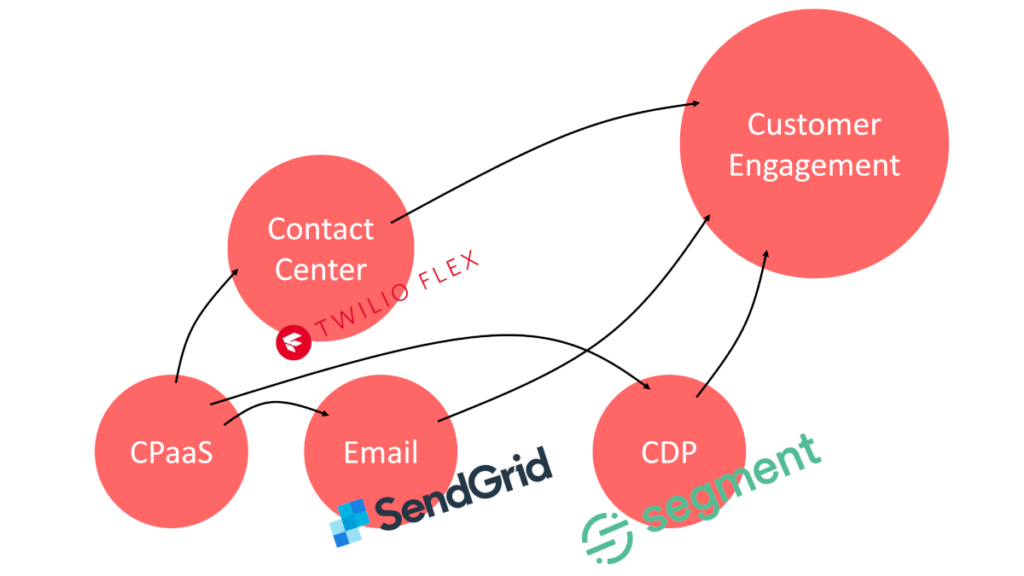

If you look at the communications market diagram above which I like using, then Twilio encompasses two of the three domains. The difference now is that it is vying towards the CRM part with its new story of a customer engagement platform.

The pillars of Twilio’s Customer Engagement Platform?

From here on, the keynote was focused on showcasing everything revolving around customer experience with trust, scale, reliability and compliance as the main themes.

FUDing the enterprise

To hammer the message through, Twilio decided to harness the “digital giants”. In its mind, these are Amazon, Google, Netflix and Facebook. An odd choice, as Apple and Microsoft would be “gianter” than Netflix…

The reason behind this, is that these companies make the best use of customer data to improve its engagement with its customers, providing a singular, cohesive view of them.

Logic states that these digital giants have grown with the pandemic because they understand their customers better, and other vendors need to follow suit or be gobbled up by these digital giants.

Now that we want to be like them, we need to have the technology to do that. Amazon didn’t buy its CRM from anyone, it built it. It fed it with the data needed. And so do you dear vendor – you can’t rely on an existing CRM – you will need to build it. And just accidentally, Twilio Flex is what you need to build it (wink wink 😉😉).

Oh, but it isn’t Twilio Flex. It is actually Twilio Flex + Segment + machine learning.

To hammer that in, Jeff made sure you know that you don’t want the digital giants as your partners when it comes to your customers: Amazon taking a cut of each purchase,the Apple tax, Facebook and Google auctioning user attention via ads. You dear vendor, need and want to own your customer relationship – directly:

Now that we’re all warmed up, it was time to share and explain what Twilio Customer Engagement Platform really is.

The Twilio Customer Engagement Platform

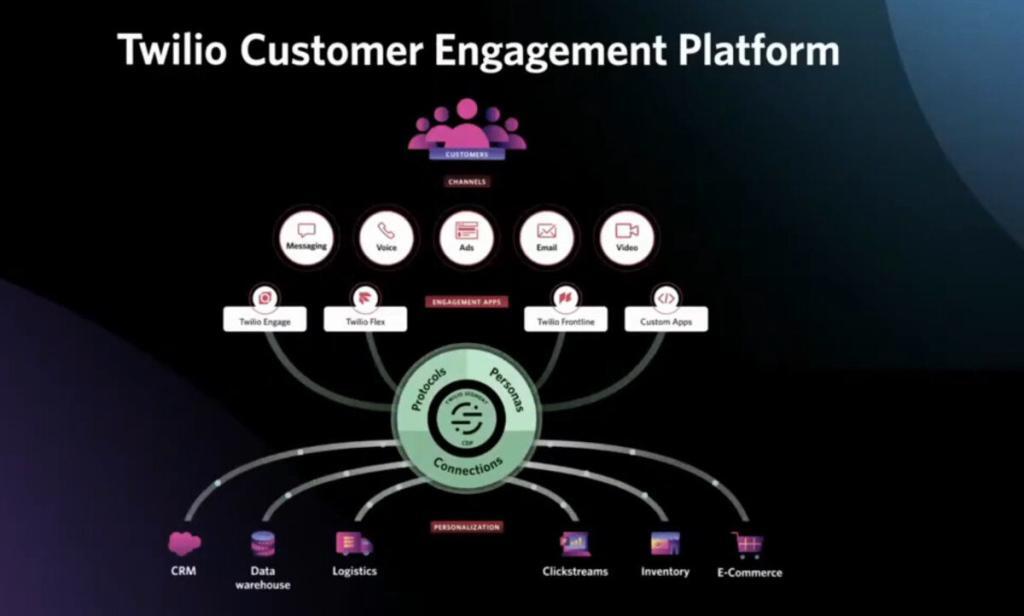

Twilio’s new Marketecture: Twilio Customer Engagement Platform

Jeff went through the platform’s components, which sits well with its current set of product offerings and acquisitions.

1. Channels

Channels are the basic Twilio building blocks. That’s roughly the CPaaS part of Twilio:

The purpose is to be where the customer is.

Messaging and Voice is what Twilio is focused on. Ads were not mentioned anywhere else. Email is the SendGrid acquisition. And Video… well… that’s almost the only place it appeared during the keynote (more on video later).

2. Engagement Apps

These are the higher level programmable applications that Twilio is offering:

- Twilio Flex for support (announced 3 years ago at Twilio Signal)

- Twilio Frontline for sales (announced a year ago at Twilio Signal, no new announcement around it in the keynote)

- Twilio Engage for marketers (announced later in the keynote)

- Custom apps are the ones you build yourself on top of Twilio’s CPaaS offering (their Channels)

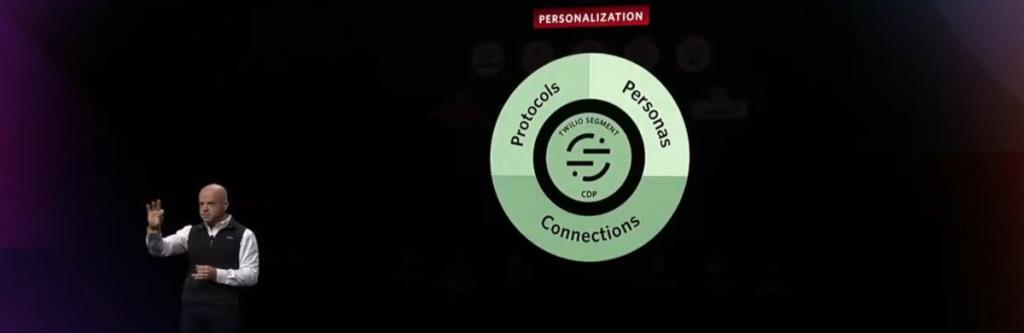

3. Personalization

Segment…

This is why Twilio acquired Segment a year ago, and this is where it is taking Segment next.

The reason behind acquiring Segment was to pivot towards customer engagement and provide a larger offering to larger enterprises.

As Jeff said it, this is about engaging customers in real time at scale – that’s the focus of Segment.

From here, the keynote went to specific product announcements.

Twilio Signal 2021 keynote announcements

During the keynote, several official announcements were made. There were others that didn’t make it into the keynote itself, which goes to show where the main focus is.

Here are the things announced in the keynote:

- Regional Twilio – running the Twilio stack and connecting to it over different geographical regions

- Twilio MessagingX – a rebranding of its SMS and omni-channel offering

- TrustHub – managing compliant phone numbers

- Google Business Messaging – support for Google Business Messaging

- Content API – new API for managing messages across channels

- Twilio IVR Now – helping contact centers migrate from on prem IVRs to the cloud

- Twilio Intelligence – a new business process automation platform for the contact center

- Twilio Flex

- Twilio Flex ONE – single API for multiple channels in Flex

- Twilio Flextensions – marketplace for partner extensions and implementations for Flex

- Segment

- Twilio Engage – marketing cloud engagement app for marketers

Regional Twilio

Jeff introduced this first and explained that this was their biggest architectural change.

Twilio switched from a single US based data center to enabling running the Twilio stack from multiple regions. A customer can potentially choose where he wants to connect to Twilio and where he wants his data to reside.

The main difference is lower latency on API calls if sent to the same region, but mainly the ability to choose where to run and store the data.

The actual deployment of this is going to happen in stages with a growing number of locations as well as products enabled. This will start with two new regions – Australia and Ireland, to cover Europe and Asia by year end for Twilio Voice; while Twilio Segment can store data in Europe.

The main reason for this is the growing need to support regional data storage to meet regulation in different countries and the need to entice larger enterprises to use Twilio.

This was announced before the explanation of the Customer Engagement Platform, but I decided to place it here, as part of the announcements of the keynote.

Twilio MessagingX

The first announcement after introducing Twilio Customer Engagement Platform was Twilio MessagingX – the Channels layer in the new marketecture. This is also where the heart of the Twilio CPaaS solution lies.

It started nice. Soumya Srinagesh, Twilio’s VP Messaging Exchange, shared her big number:

Somehow, it differed from Jeff’s by 28B. I am sure there’s a good explanation, though either way, 100B is a large enough number.

SMS centered, but evolving

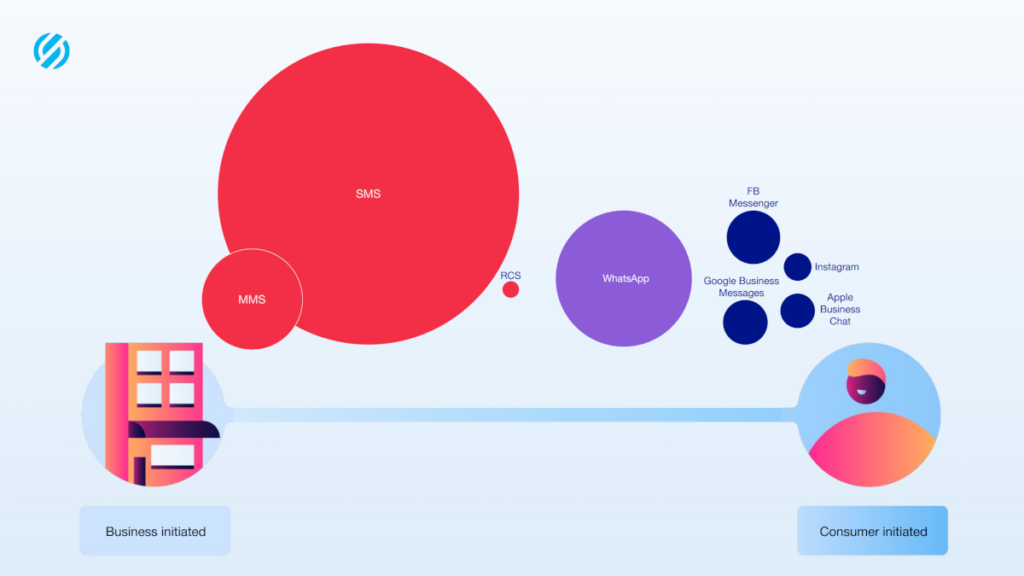

For Twilio, messages are still SMS. It wasn’t said out loud, but it was hinted strongly enough throughout the session based on the announcement and in the analysts briefing for Twilio MessagingX:

During the analyst briefings of Twilio Signal 2021 the above slide was shared. I like it because it says a lot about how Twilio sees things in the messaging space. I also like it because of the way things are arranged.

Here are my immediate insights from it:

- SMS is the biggest channel by far. Everything else is just noise

- Whatsapp comes second, and then Facebook Messenger

- RCS is puny (it is still dead before arrival)

- All of the above is true because Twilio deals with business to consumer communications

- Until now it was mostly business to consumer

- Whereas the future is in conversations where consumers initiate more of it, where social networks and Apple/Google are more important

- It also doesn’t take into account communications that aren’t business to customers. Business to business and just person to person, which may happen in other channels

What is Twilio Messaging X?

So what exactly is Twilio MessagingX?

It looks at messaging not from the API building block level, but rather from 3 different perspectives, each with its own set of focus and investments: Trust, Quality and Choice.

To be clear, all CPaaS vendors strive to do that. Twilio is one of the few that are big enough with economies of scale to really deliver it, and do so with programmability in mind in all of the possible layers.

Trust

To handle trust, mainly deliverability and compliance, Twilio announced TrustHub.

TrustHub is all about compliant phone numbers (did we say SMS?)

It isn’t as if other CPaaS vendors don’t offer compliant phone numbers. TrustHub does that by enabling access to it via APIs as well, making it… programmable? More flexible?

The intent at the end of the day here is to have messages pass unfiltered and not get them to be blocked by carriers. Especially now, when our phone’s spam folders for SMS and voice are full of such numbers and messages.

This initiative is starting with the US market and will expand elsewhere.

Quality

This is about deliverability by selecting which carriers to use to route messages, and figuring out bad connections. Twilio does that proactively (other CPaaS vendors do or say they do as well).

Not much else was said about it during the keynote, but this is where many of its acquisitions and investments in communication providers such as Syniverse earlier this year come to play.

This is a topic for a separate future analysis though.

Choice

Choice is omni-channel. The ability to send messages to users on the channels they prefer.

There were two announcements around choice that were made:

1. Google Business Messages

Twilio already had SMS, Facebook Messenger and Whatsapp. Now they added support for Google Business Messages – the ability of customers to start a conversation with a business directly from a Google search result or a map listing.

Interestingly, Twilio still has no Apple Business Chat support. Probably because Apple doesn’t want to deal with generic CPaaS vendors just yet.

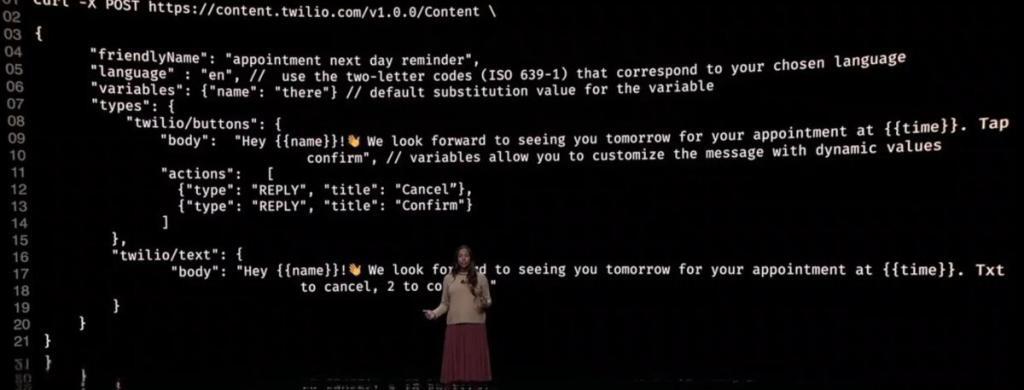

2. Content API

To manage and handle the fact that each messaging channel has slightly different rules you need to deal with, the new Twilio Content API is there to allow writing a message once and delivering it on whatever channel, with Twilio taking the headache of matching the message you want to send to how each channel likes that message.

As messages become more complex, requiring the user to take actions for example, such an API becomes a nice add-on.

For the most part, it feels like a utility that reduces a lot of the headache of a developer.

Twilio Voice and IVR Now

This was the first time voice was discussed. It was preceded by this nice number:

We had 25B calls, now with 36B voice minutes. If both relate to voice, then that’s 1:26 minutes per call on average. Transactional is the main focus of Twilio.

Not much more has been said or announced about Twilio Voice directly. The only thing was IVR Now, with about a minute spent on explaining it:

IVR Now seems to be a program that is designed to assist enterprises to migrate their VoiceXML from on premise IVRs to Twilio’s IVR. If I had to guess, this is about offering professional services either by Twilio directly or via partners.

The reason for sharing this during the keynote was to get enterprises listening in to talk to Twilio about it – there still isn’t anything on Twilio’s website about this program…

Other than that, it felt out of touch with the rest of the keynote.

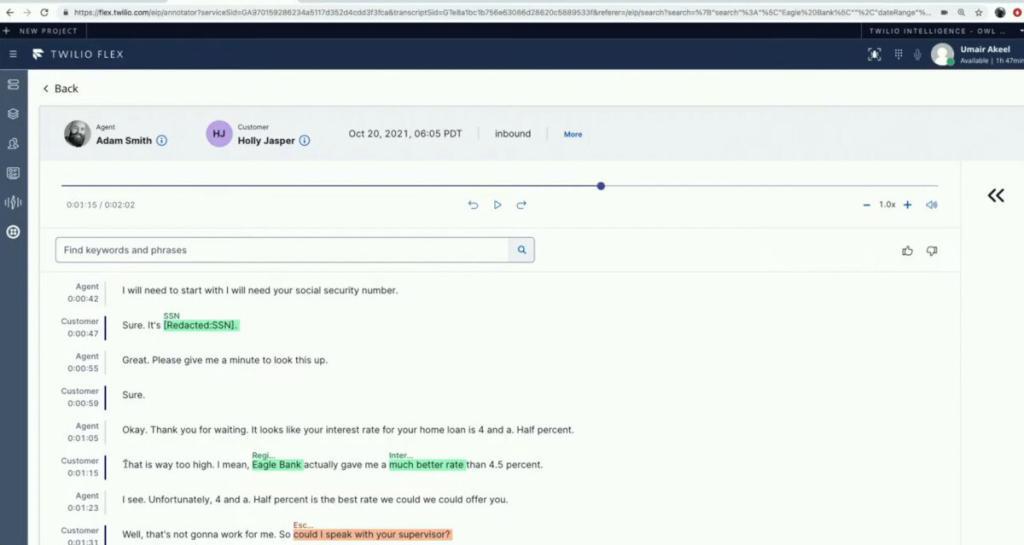

Twilio Intelligence

Al Cook, VP & GM, Artificial Intelligence was the one introducing Twilio Intelligence. Al was the one leading and announcing Twilio Flex a few years ago, and this in a way is an extension of it.

The premise of Twilio Intelligence is the need to get from voice to data to meaning.

Twilio Autopilot was released to beta in 2018 and GA’d during Twilio Signal 2019. Interestingly, this is a platform and not a product (which means it probably is still Twilio Autopilot).

What is included?

- Driven by conversations

- Your own switch transcription engine and language understanding capability

- The transcription engine itself was built by Twilio, not using third parties

- This reduces the price points for Twilio and increases their ability to deliver a specialized solution

- The data used to train the engine was labeled with type of data and calls that Twilio sees with its customers

- This leads to accuracy higher than 90% (based on Al’s explanation)

- The Twilio transcription engine is included in the Intelligence platform but can also be used as a standalone API

- Accents were mentioned but not languages, so this is probably English only at this point in time

- The intelligence part comes with language operators which can be trained by the vendors themselves

A view of the language operators of Twilio Intelligence as implemented as part of Twilio Flex

Here’s what it means that Twilio Intelligence is a platform:

- This isn’t a specific product, but a mix of multiple Twilio products and capabilities

- Twilio voice recordings will now offer transcriptions, most probably with diarization based on the channels in the call

- Segment stores the data

- Twilio Studio is used to manage and automate decision trees based on the language operators

- Twilio Autopilot or something newer/different is used to sift through that data to get to the understanding part of it

- Twilio Flex holds all that glue together with the application level implementation of it all

The demo was quite interesting, so I decided to share the direct pointer to it in the keynote here, as that’s easier than explaining it:

What I think:

- This is the holy grail of call centers

- Being able to understand conversations at scale

- Automate proactive actions

- Do things intelligently

It is hard work, and it will be interesting to see if Twilio nailed it this time around and what the next iteration of this will look like.

Where and when?

Now in limited private beta. A broader private beta in early 2022.

English only for now. Voice based for now.

Twilio Flex

Twilio Flex launched 3 years ago. At the time, it was questioned if this would be successful or not. To some extent, it still is. The interesting thing is that the same was said about Amazon Connect, which took about 3 years to mature enough to show its size in the market.

Sateja Parulekar, Head of Contact Center Solutions at Twilio made it a point to explain that:

- Large contact centers are already using Flex

- Flex is the fastest growing product at Twilio (though no specific numbers around size were given, besides the 0.5B interactions at the beginning)

There were new announcements around Flex, mainly Flex ONE and Flextensions.

Flex ONE

Flex ONE is about adding new channels to the Flex contact center with a single API. That includes today voice, messaging (including Whatsapp), chat and email.

The end result is one page holding all conversations across all channels with the customer.

Flextensions

Flextensions are pre-build extensions to Twilio Flex. To me it sounded much like Zoom Apps or application directories of other enterprise tools.

This is geared on top of the partnerships that Twilio has been working hard on and explained in last year’s Signal 2020 when they discussed the Twilio Flex ecosystem. It is the right move for the Flex platform.

From a product perspective, the future of Flex lies in its integration with Segment. This is where Twilio Intelligence is most focused on, as we’ve seen in its introduction and demo.

Segment

Peter Reinhardt, GM of Twilio Segment came to explain two things:

- What is Segment and why Twilio acquired it

- Announce Twilio Engage

What is Segment and why Twilio acquired it

Segment is about collecting customer data from multiple sources and making it available as the single source of truth to wherever the business needs that data – all in real time.

Businesses store data about customers in many different places. With the migration towards cloud and SaaS, the number of these places is growing fast. I know… my own small business to run this website and my courses have their own share of SaaS vendors that I am using, all cobbled up with half-made integration and knit together with this masking tape called Zapier. It works. For my single person small business. Somewhat (I have tons of things I’d love to have better integrated, but don’t have the time or inclination to do – not enough ROI in it).

For real businesses, not like mine, the problem is a lot bigger and a lot more important to solve. Especially if… you want to be like the digital giants Jeff talked about at the beginning of the keynote and Peter made sure you remembered.

But back to the why:

- Businesses need a glue for their customer data. And Segment is a nice glue. A super glue

- Twilio does communications APIs. And is going after businesses, especially where businesses need to communicate with customers

- So the data used to decide if and how to communicate resides in Segment, or gets pushed to Segment from Twilio

- A win win if you could integrate these two together

And we’ve already seen glimpses of it with Twilio Intelligence earlier on.

I think Segment was the most interesting acquisition of Twilio so far. It isn’t only closing a gap on something they don’t have or need. It isn’t even going after a close adjacency. It is about being able to double down on customer engagement… and building a platform for it.

Which is exactly where Jeff started and where the keynote ends.

Twilio Engage

Twilio Engage was the last announcement. This is the new engagement app that Twilio decided to launch. Flex is for support, Frontline is for sales and Engage is for marketers. This is the marketing cloud offering of Twilio, built on top of Segment.

It is available in pilot now and as GA in Q1 next year.

Not much else was explained or shared about this and the demo was mostly a concept of what can be done with it. Next year’s Signal event will probably show the flashy UI Peter said was less important than the data 😉

Announcements that didn’t make it into the keynote

Video. IoT. Frontline. Sendgrid.

Probably a few others that I missed.

I’d like to discuss 2 of these announcements here in brief.

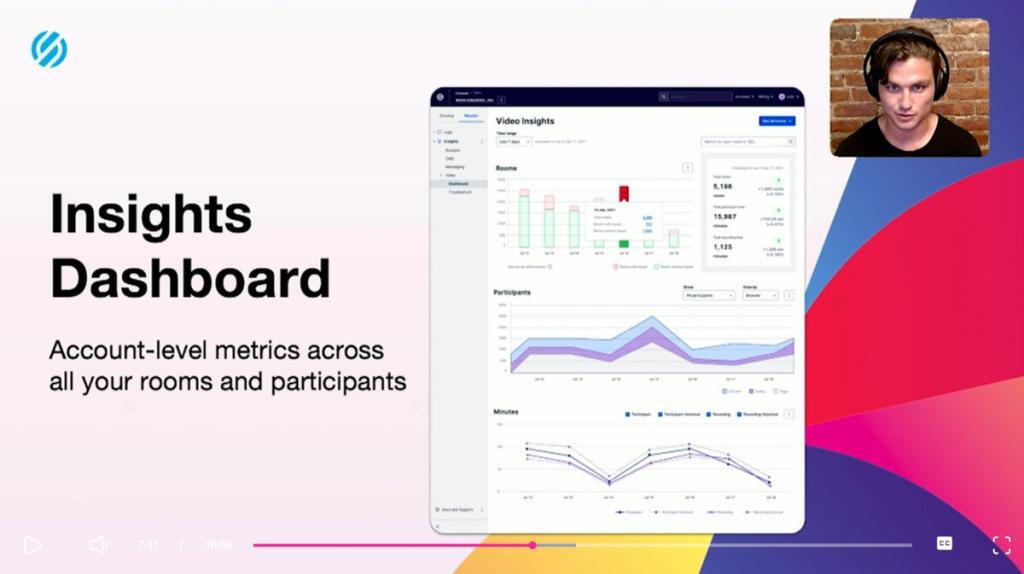

Twilio Video Insights

Video isn’t (and was never) top of mind for Twilio. They have it supported, but somehow it feels like a second class citizen most of the time: Twilio WebRTC Go was announced in Signal 2020 to give a semblance of progress with video. It is a free peer-to-peer video service from Twilio that is limited in scale. It got some increased capacity this year especially for Signal 2021. Nothing to write home about (I already discussed these free WebRTC video APIs at length recently.

What was announced was Twilio Video Insights and Twilio Video, both very different from each other.

Twilio Video Insights collects WebRTC and other statistics off of your calls done over Twilio Programmable Video, to create a dashboard view of media quality.

This is similar to what we do at testRTC with our watchRTC product.

A demo was shown in one of the sessions of Twilio Signal.

For me this validates our own watchRTC product, as Twilio saw the need to offer that out of the bex as part of its service. That said, if you need something like this (for Twilio, another CPaaS vendor or your own infrastructure), then come check for yourself which tool is most suitable for your needs.

Twilio Live

Twilio Live was announced a bit prior to Signal 2021. Probably in order to give center stage to Twilio Customer Engagement Platform where Live (or video for that matter) play a marginal role if any.

Here’s what I learned about Twilio Live during Signal 2021:

- Twilio Live offers “interactive” audio and video

- “Interactive” because there’s a 2 seconds latency end-to-end

- It isn’t WebRTC on the viewer’s end, which can probably be blamed for that 2 seconds of latency

- The problem with this is that today’s CDN streaming solutions that can go down to 5-10 seconds, and with further optimizations of their existing technology stacks down to 2 (using LLHLS for example)

- Their competition from WebRTC streaming vendors is that these vendors support subsecond latencies, usually at the 500 milliseconds mark

- CDNs are probably cheaper. WebRTC streaming vendors will probably be on par with Twilio’s pricing

- Main reason for selecting Twilio here is if you’re using the Twilio stack elsewhere as well, but it might not be enough if what you are looking for is real interactivity

- Yes, 2 seconds delay is great for most use cases, but not for all of them

- It reaches millions of users on a single stream

- I’d estimate that Twilio Live runs like a traditional CDN streaming service

- It sends data over TCP (using HTTPS or a secure Websocket), so there’s no packet loss and there’s buffering added to deal with potential retransmissions

- It probably also does ABR (adaptive bitrate), to deal with different bandwidth availability of different users

- Twilio Programmable Video Group Room is used as the source of the content

- Which means the broadcasters are using WebRTC

- Since a single outgoing stream is sent towards Twilio Live, this gets mixed and “recorded” and then sent to the audience. All this is probably done by a headless chromium instance in the cloud somewhere

- The fact that the content is mixed means that all viewers can only see the exact same layout. Less flexible, especially for the interactive type of use cases with several broadcasters

It is an interesting route that Twilio took for its broadcasting service. I am not sure how well it can compete with other CPaaS vendors who are clocking 100s of users or more per single WebRTC session. And it is hard to see this as an alternative for those using CDN streaming services already.

What will be interesting to see is how vendors accept this product and its position in the market – will this be good enough or even perfect for certain customers that can’t find the right solution for their broadcasting needs elsewhere.

What Twilio isn’t

After writing down this longform article and analysis of Twilio Signal 2021, I think the most important part is what wasn’t said. And that’s what Twilio isn’t.

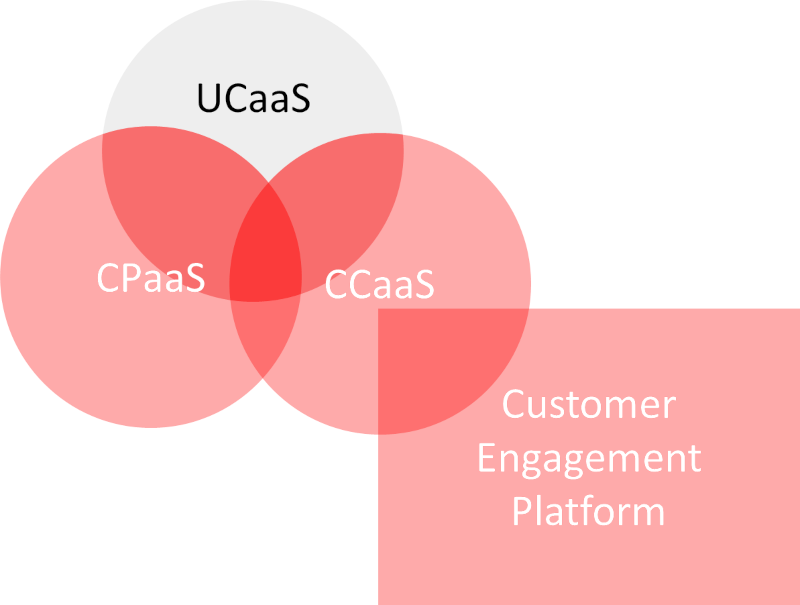

I long suggested and thought that CPaaS, CCaaS and UCaaS are going to merge as the lines between them are blurring. Vendors in each of these segments are vying towards the others through new product announcements and acquisitions.

Twilio went after CCaaS with Flex. It only made sense it would move into UCaaS at some point, being a comfortable adjacency in communications.

But it didn’t.

It went after customer engagement. Acquired Segment and doubled down in this route – making a splashing announcement of it at this Signal event and keynote.

Twilio is all about businesses communicating with customers.

Twilio is a lot less about people collaborating with each other in a business. Why? Because that’s where the focus of UCaaS is, and a lot of that focus relies on a slightly different set of requirements and roadmap.

This is also why video is getting less attention by Twilio for example.

What’s next for Twilio?

I don’t really know.

This can be seen as a pivot, but also as the next step in Twilio’s evolution.

Twilio is surprising with the way it handles itself in the market, at least for me.

If I had to bet, I’d say that the next 2-3 years are going to be more of the same. Twilio will work on its current set of engagement applications, pouring data from the Segment CDP into it, and fitting its solutions for sales, support and marketing. Obviously, developers are still an important part of all of this.

I wouldn’t expect Twilio to go into additional adjacencies in the API domain or to go after unified communication related use cases either. At least not now. They have their hands full going up market and out of their comfort zone of pure communications.